Michael Coyle’s career journey exemplifies strategic ambition and adaptability. As the founder and CEO of Portl, a lifestyle, loyalty, financial, and social app, he is spearheading an innovative platform set to launch in Dubai before expanding globally. His trajectory from Galway, Ireland, to Dubai reflects a calculated move to achieve greater impact in a competitive, fast-paced environment.

Building a Foundation in Galway

Hailing from Galway, Michael made his mark in Ireland by founding and leading one of the country’s most successful marketing agencies. Specialising in the fitness industry, he collaborated with notable influencers like Rob Lipsett, creating campaigns that elevated brands and strengthened their market presence.

Michael’s contributions to Ireland’s marketing landscape were significant, but his vision extended beyond local success. It’s almost there, but it could use a small adjustment for clarity. Recognising the limitations of operating solely within Ireland, he set his sights on broader horizons and landed in Dubai. With its business-friendly environment and international appeal, Dubai became the ideal location for his next venture.

The Move to Dubai and Conceptualizing Portl

Michael relocated to Dubai to pursue larger opportunities and develop a project with a global footprint. Inspired by the gaps he observed during previous cryptocurrency market cycles, he aimed to design a platform that would merge lifestyle and financial tools with real-world usability.

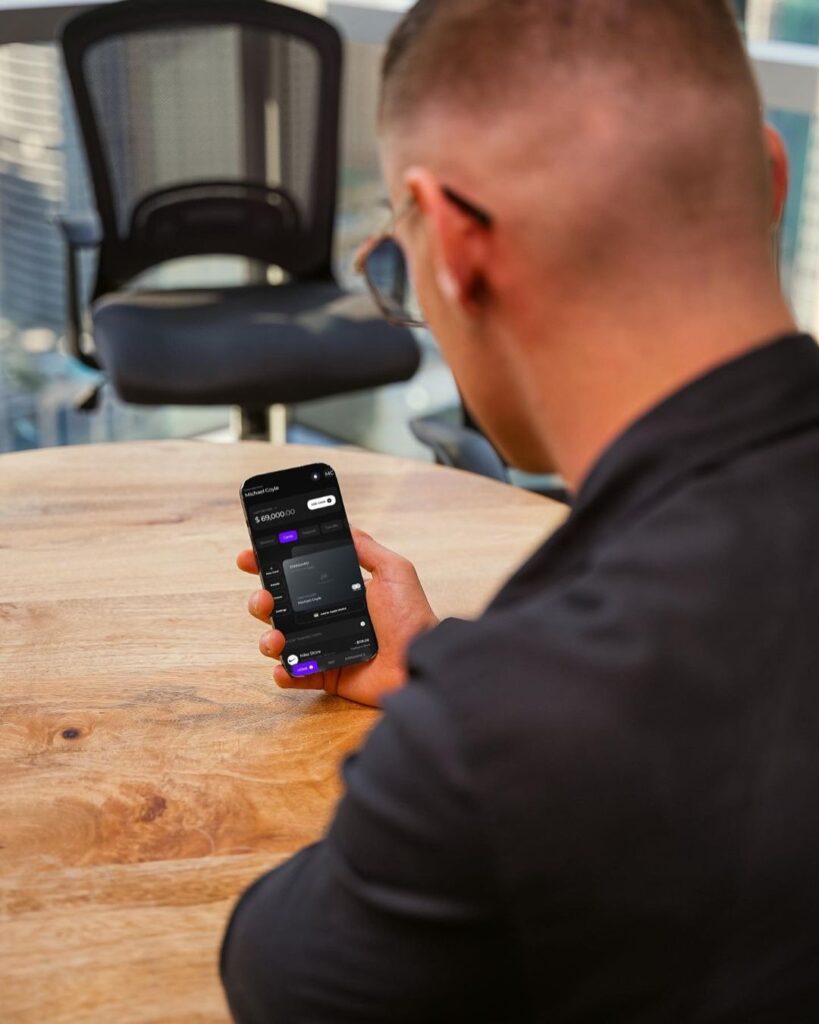

Portl emerged as a comprehensive app addressing multiple user needs—offering loyalty rewards, financial services, and social networking capabilities within a single platform. Michael’s idea for the app was rooted in a desire to bring practical value to users, avoiding the shortcomings he identified in many crypto-related projects during earlier market booms. For example, the ability to use cryptocurrency for payments, while the host receives the equivalent in dollars, euros, dirhams, or any preferred currency.

Positioning Portl for Success

With the cryptocurrency market rebounding—Bitcoin recently reaching an all-time high of $93,400—the timing of Portl’s launch aligns strategically with heightened interest in digital assets and innovation. Michael’s ability to anticipate market trends has played a crucial role in the app’s development, ensuring it is well-positioned to succeed in both the lifestyle and financial sectors.

Initially launching in Dubai, Portl has already secured partnerships with several of the city’s prominent venues, reflecting its potential to integrate seamlessly into the region’s luxury-driven market. These collaborations emphasise Portl’s dual focus on providing value to both consumers and businesses.

Portl operates at the intersection of fintech, lifestyle services, blockchain, and digital advertising, offering AI-powered concierge and financial solutions.

By combining elements of social interaction, financial tools, and AI-powered convenience, Portl stands at the forefront of the Web3 lifestyle app space.

This exciting new start-up has been recognised as one of the top ten emerging fintechs in the UAE, with an official launch expected in January 2025, and global expansion the following months.

A Measured Path Forward

While Michael’s early career achievements and contributions to Ireland’s marketing industry set the stage for his move to Dubai, his approach remains pragmatic. Portl represents a calculated effort to deliver innovation in a crowded digital space, built on a foundation of extensive planning and market analysis.

As Portl prepares for its rollout, its success will hinge on its ability to meet user expectations and adapt to market dynamics. With a clear focus on utility and partnerships already in place, Michael Coyle’s transition from Galway to Dubai signals a deliberate shift toward achieving lasting business impact on a global scale.